Tanker rates for VLCCs are flying higher as China imports of crude swell by 900Kbpd YTD to 7.6Mbpd. This year, the rate for VLCCs has climbed from a low of $14,400/Day to $52,600/Day.

Environmental regulations elsewhere are driving demand for LNG as

JERA out of Japan (world's largest LNG buyer) recently stated it made an

initial purchase of LNG cargo from the US, as well as Italy announcing

its first cargo of US LNG according to Credit Suisse.

Goldman Sachs sees the potential for idle

vessels (8% of the fleet currently) to skew the currently balanced

supply/demand market, which the bank says "remains fragile." Goldman had noted previously that "The top six carriers, grouped into three alliances now control nearly 80% of intercontinental trade flows." This means fewer new ships will be ordered and thus the "recent consolidation will underpin a rate restoration from record lows a fewer new ships are order, allowing supply-demand to gradually re-balance." according to Goldman.

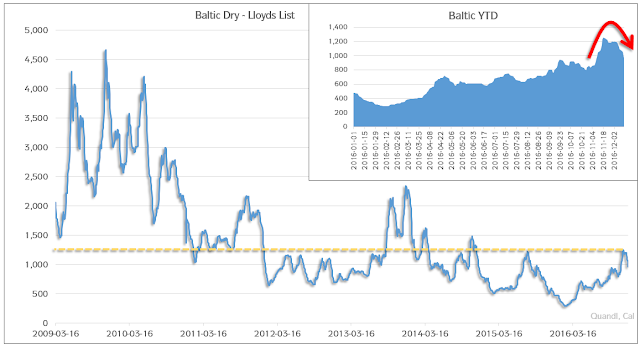

And that explains the skewing of BDI, which remains shit even after the most recent jolt above 1,000:

Sell the ship names you see flying higher.